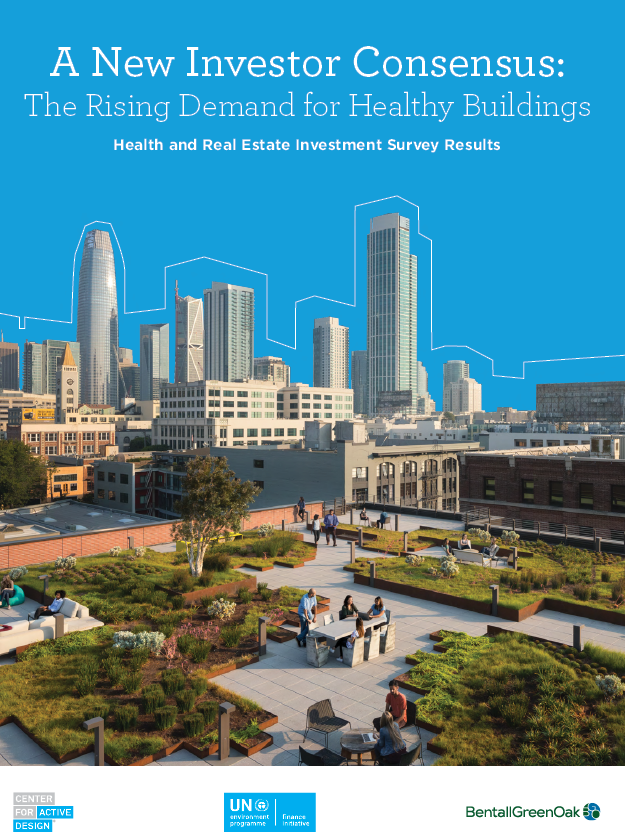

The Rising Demand for Healthy Buildings

The growing prominence of Environmental, Social and Governance (ESG) criteria in financial decision making has transformed the real estate sector, pro- viding measurable reporting on the social impact of investments in the built environment. To date, two ESG pillars—Environmental and Governance— have become more widely used, with well-defined metrics and broad acceptance within the industry.2 The Social pillar is a growing force in real estate investment criteria, due in part to increased aware- ness of how the built environment impacts human health. The places where we live, work, study and socialize can and should play a central role in im- proving human health.3 To evaluate how health and wellness is emerging as a major component of ESG criteria, as well as how COVID-19 is influencing investors’ approach to these issues, the Center for Active Design (CfAD), United Nations Environment Programme Finance Initiative (UNEP FI) and BentallGreenOak (BGO) collaborated to gather feedback from a globally diverse set of real estate investors. Unless stated otherwise, we are using the term “investors” in this report as shorthand to describe a cohort of diverse respondents—a combination of owners (those providing capital) and asset/fund/ investment managers (those investing and manag- ing the capital on behalf of the owners). We used a two-pronged approach, gathering both quantitative and qualitative data, to pulse inves- tors’ current attitudes toward integrating human health into investment decisions in the midst of the global COVID-19 pandemic. In November and December 2020, we fielded a multi-part survey that yielded the quantifiable feedback presented here. We also conducted supplemental interviews with industry leaders to record their perspectives on investments they identified as “health-promoting.” Our team then synthesized this research—complimenting it with additional desk research and data analysis—to gauge investor sentiment and propose future directions for the sector. With the survey and structured interviews as its cornerstone, this report is the first of its kind and scope to quantify the magnitude of investor demand for healthy buildings and how that demand has shifted in response to COVID-19. It also looks at the motivations behind this demand, identifies healthy building metrics already in use by the real estate industry and considers future trends that may impact investment decisions prioritizing health and wellness.